A renowned trader specializing in cryptocurrencies recently conveyed an optimistic outlook on Ethereum (ETH) compared to Bitcoin (BTC). In a recent discussion shared on the social platform X, altcoin expert known as Sherpa and operating under a pseudonym, pointed out that the ETH/BTC pair is exhibiting remarkable resilience, stating that it is “still holding very strong.”

Sherpa emphasized that the current position of this pair is favorable for long-term investments, particularly in light of the potential approval of a spot Ethereum ETF by the SEC. The anticipation is that “ETH is almost certain to achieve new all-time highs before the year concludes.”

Presently, Ethereum is valued at 0.05457 BTC (approximately $3,142). To surpass its record high of 0.15636 BTC observed in November 2021, it would necessitate an increase of approximately 187%.

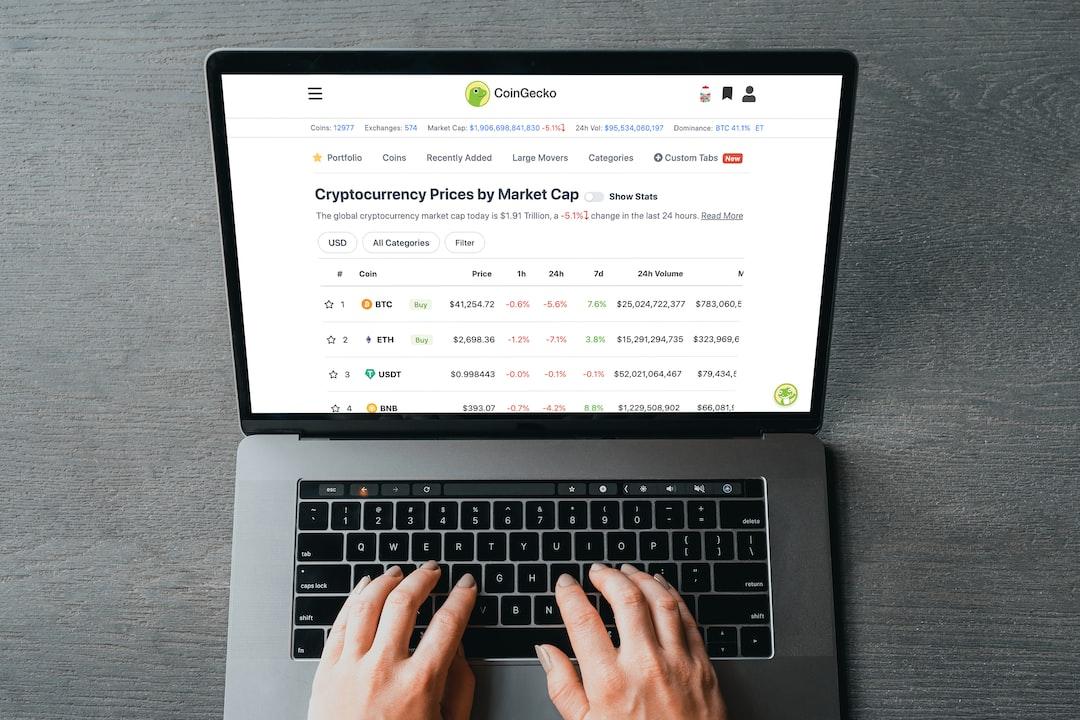

In a tweet dated July 3, 2024, Altcoin Sherpa tweeted: “ETHBTC still holding up pretty strong. I still think this is a fine spot to get in before ETF- is it priced in? Probably. But ETH to all-time highs is almost guaranteed before the end of the year.” [image here]

In regards to Bitcoin, acknowledged as the leading digital currency, Sherpa remarked: “The price is currently within a broad high range spanning from $73,000 to $56,000, though the short-term outlook appears bearish.”

Additionally, Sherpa envisions a potential upsurge in the altcoin market in approximately three months. He remarked, “Altcoins continue to undergo sell-offs, and I foresee this trend persisting. The expectation of a summer ‘alt season’ remains puzzling to me. While a surge in ETH ETF bids could potentially catalyze such a season, a robust BTC performance is typically necessary for such a scenario. Though still feasible, I maintain a cautious stance. It’s probable that a retracement and consolidation phase will prevail over the next few months, leading to a promising Q4.”

Disclaimer: The opinions expressed by the author and any individuals referenced in this article are purely for informational purposes and do not serve as financial or investment advice. Engaging in cryptocurrency investment or trading carries the inherent risk of financial loss.

Editor’s Pick: SEC Progresses Ethereum ETF Procedures: Latest Developments Ethereum and AI Tokens: Highlighted Options for Q2 2024[]